GreenLight® Debit Card & App For Kids

The Debit Card for Kids and So Much More!

Teach your kids how to learn manage money, set savings goals, spend wisely and invest!

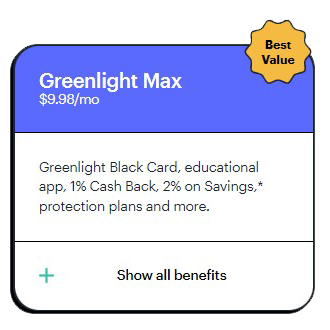

- Greenlight celebrates smart money management by rewarding kids with up to 1% Cash Back and 2% on their Savings balances.*

- Send money to your kids — anytime, anywhere.

- Get real-time notifications any time the card is used.

- Create in-app chore lists and tie the work to perks.

- Allowance on autopilot. Weekly or monthly, you can set it and forget it.

- Personalize your kids’ debit cards. Selfies rule.

Frequently Asked Questions

Is there a minimum age?

We support kids and grownups of all ages. No minimum (or maximum) age here.

How much does it cost?

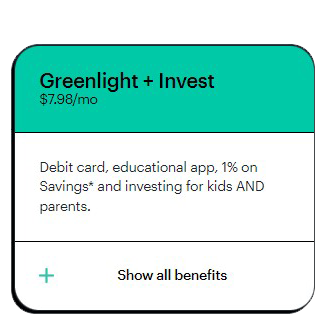

Greenlight plans start at $4.99 per month and include debit cards for up to five (5) kids. Your first month is on us, and you can cancel at any time. See our Plans page for more.

What do I need to sign up?

Your email address Your mobile phone number Your child’s/children’s name(s) Your legal first and last name Your physical address Your date of birth Your Social Security number (SSN). For information on why we ask for your SSN, learn more about the U.S. Patriot Act. A valid debit card or bank account

Where is the card accepted?

The Greenlight card can be used almost anywhere Mastercard is accepted, online and in-store. “Almost,” because our cardholders are kids, and we’ve put important guardrails in place. Greenlight also works internationally in 150+ other countries, with no foreign transaction fees. No need to let us know if you travel abroad — you’ll have enough to remember.

Is Greenlight safe?

Greenlight blocks ‘unsafe’ spending categories, sends real-time transaction notifications and gives parents flexible ATM and other spending controls. We also provide additional layers of protection to our families in the form of face or fingerprint recognition and the ability to turn your card on or off directly in the app. Greenlight debit cards are FDIC-insured up to $250,000, and come with Mastercard’s Zero Liability Protection.

*Greenlight and Greenlight + Invest families can earn monthly rewards of 1% per annum and Greenlight Max families can earn 2% per annum on an average daily savings balance of up to $5,000 per family. Only Greenlight Max families can earn 1% cash back on spending monthly. To qualify, the Primary Account must be in Good Standing and have a verified ACH funding account. See Greenlight Terms of Service for details. Subject to change at any time.

Plans for Every Family!